Interest BY Depreciation

Introduction

An important subject within traditional economics is the so-called Term

Structure of Interest Rates. Go to Google and type "term structure of interest rates" (with

the quotes) in the search box. To get an idea of what's meant by it:

The subject is important, because it can yield Lots of Money for the one

who can predict future term structures. Nobody has hitherto succeeded in

achieving that goal, though. We will see in the end why this shall be so.

Idolatry

Money, instead of a medium of exchange, has become an Idol.

Our goal in life has become: Making Money, instead of: Getting a Life.

Or rather: we think that there is no other way of getting a life than

through worshipping Money. However, according to the

Ten Commandments it reads:

4 You shall not make for yourself an idol, [ .. ]

5 You shall not bow down to them or worship them;

Anthony Quinn's father once asked him as a child: "do you want to

have a hot dog?" "Yes", he responded, but accidentally dropped the

coin that was meant for paying. As Anthony wanted to grab the coin, his

father said: "No! Never bow for money!". And they went home, still

hungry. (From the top of my head; details may easily be wrong)

A fact is that two of the ten, twenty percent (in words even more ?) of

the commandments are about making oneself an Idol. Idolatry is thus considered

as a great danger.

Idolatry just means that worshipping of a dead thing, which is made

by our own hands, read: Money, is prefererred above Life itself.

According to the Bible, this is a deadly sin. Of course it is. You don't even

have to be converted to recognize some truth in there. In many religions, it is

thought that Eternal Life is our destiny. Read: our destiny, we

as a species, not any of us as an individual, because, as individuals, we are

just mortal and nothing else. But suppose for a moment that the Enduring Freedom

of our Economy is not so much governed by Love for Life ..

Theory

The so-called Term Structure of Interest Rates can be explained a great deal by

a theory which takes into account the psychology of (positive) interest-bearing

Money. This theory reveals that the primary Interest (: mind the word !) of our

GOD, the Great Omnipotent Dollar, is in the destruction of goods, also known as

: risk . Mind the word risk in this context.

According to the theory of money by

Silvio Gesell, interest is a phenomenon

which is attached to a form of money which we will call gold money. That

is: money which is historically based upon precious metals / the gold standard.

> I presume that when you say gold money, you are aware that the Gold standard

> was dropped in 1971 [ ... ]

Yes, I'm very well aware of that. But contemporary money still behaves

as if it is money which is backed by gold. And therefore it still asks

interest for it's "services". I use the term "gold money" to indicate this

behaviour.

The key reasoning is that gold remains constant in its "value" (Gesell will

curse me for this) while the goods against which it is exchanged depreciate.

Because the money which is exchanged against a good is equivalent with the

good, the money should get rusty, just as the good gets rusty. However the

money can defend itself against this threat of depreciation by charging an

additional amount of money, in order to keep its enduring value up to date.

This is precisely what is called interest, but explained from a mixed

Marx / Gesell point of view.

The point to be made here is that the money actually

needs depreciation of goods, in order to be able to charge interest.

Think about it in another way; it is advantageous for the Money that goods

are destroyed, because people are then forced to buy the same goods again.

Depreciation is loss of value - on purpose ? - but anyway, Interest is

compensating for it. As a rule of thumb:

Interest + Depreciation = 0

> The present system is simply put a LETSytem that centralizes issuance

> (mostly through private banking) and of course charges interest.

That's correct, of course. US Dollars are not really "backed" by something

productive. On the contrary, USD's are backed by counter-productive assets:

weaponry. That's one reason why the United Stated are bound to be sucked

into warfare every time again. Go to Google and type "interest and depreciation" in the search box. OK.

Now do the same thing with "interest BY depreciation" and you will find not

a single item (well, except for the present page) ! Yet I am convinced more

and more that especially the BY provides a new clue to understanding the truly

destructive nature of our money system.

There does exist a thourough mathematical theory about the depreciation of

goods, like the machines which are used in a factory. It is well known that

the chance of failure of these things can be described statistically by a

so-called exponential distribution, or probability density:

f(t) = exp(- t / τ) / τ

The accompanying Cumulative Distribution is more important to us:

F(t) = 1 - exp(- t / τ)

Here τ = the mean time between failures (MTBF), or the time that it takes

before something will "drop dead".

There are many references on the Web, even if you are searching with a rather

detailed keyword list, such as: exponential probability distribution

failure .

In some of these articles, you will find an elementary explanation.

The

gist of my theory is that the Term Structure of Interest Rates, more precise:

the Normal Yield Curve actually mimics the Depreciation

of our Goods. ( Note. The term structure of interest rates can be quite deviant

from a normal yield curve, as a consequence of psychological factors, but other

cases than the more or less "objective" one are not to be considered here. )

With other words: the Normal Yield Curve must be similar to a weighted

sum, of Exponential Decays. Speaking in mathematical terms:

F(t) = ∫ { v_L + (v_H - v_L) w(T) [ 1 - exp(- t / T) ] } dT

Where the integral is carried out over some area of interest (mind the word!)

Software

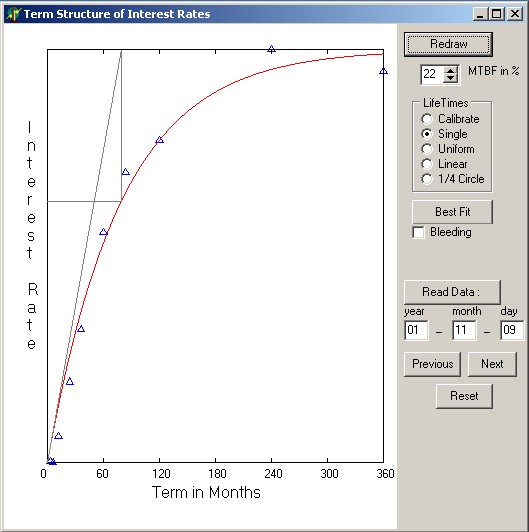

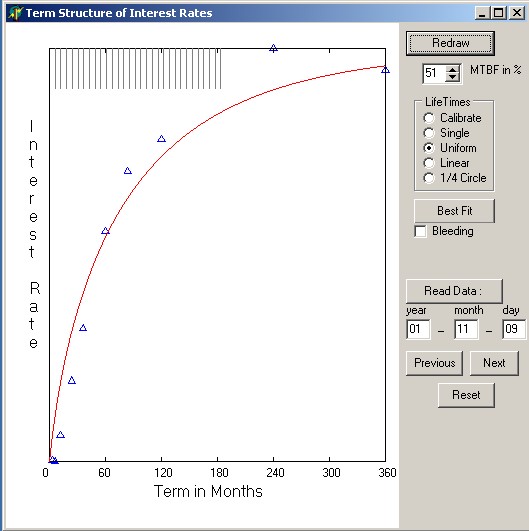

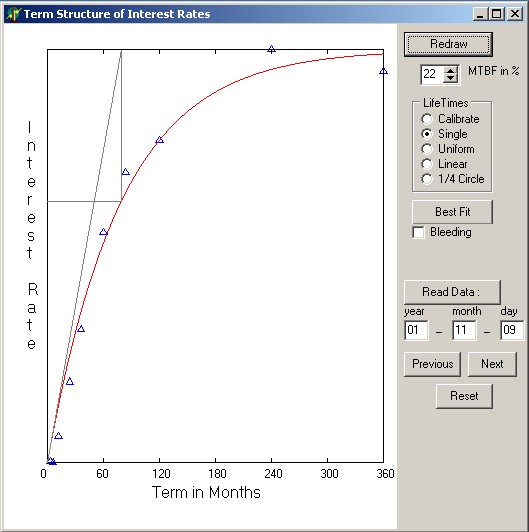

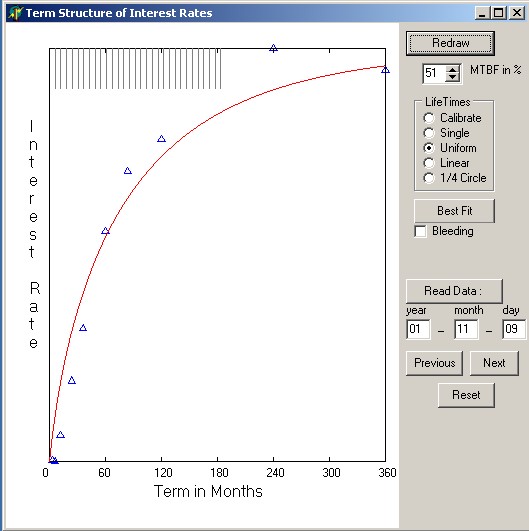

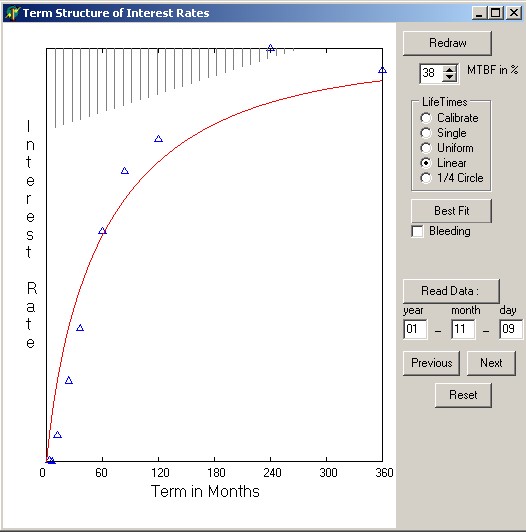

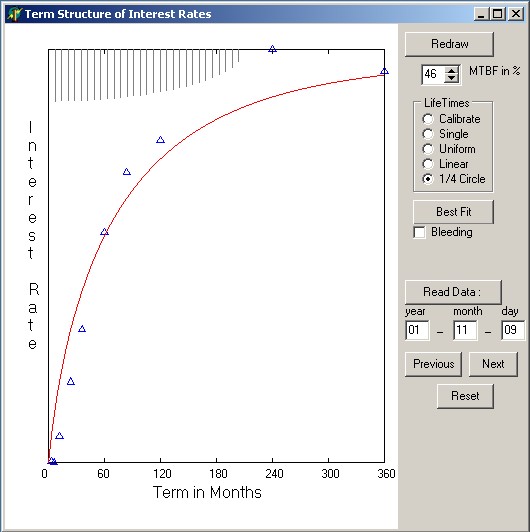

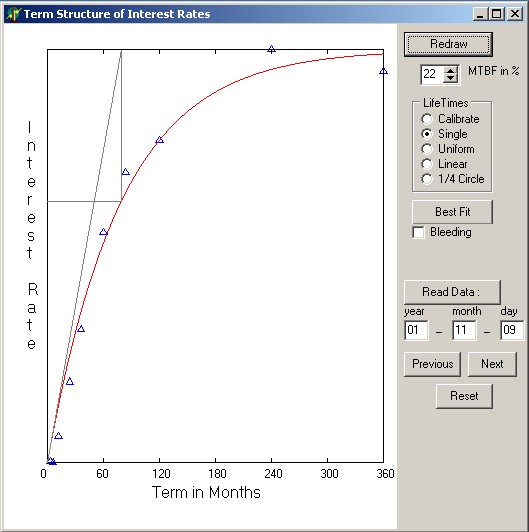

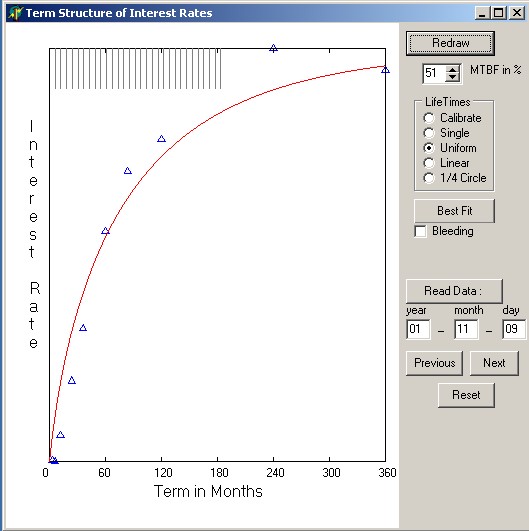

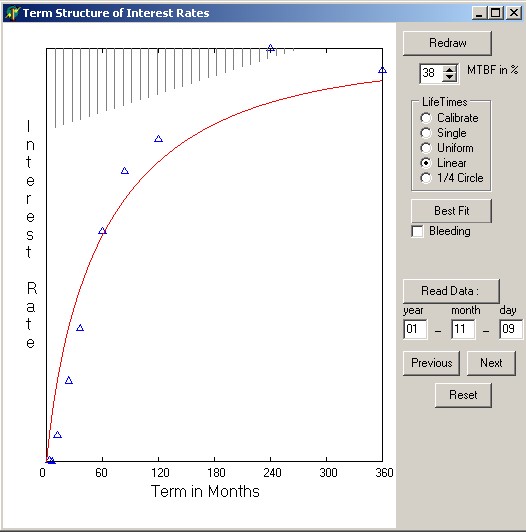

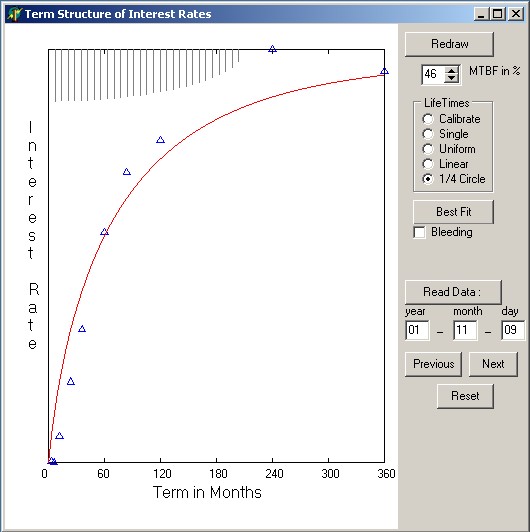

I have squeezed this theory about the Term Structure of Interest Rates into a

computer program.

There are two versions of the software: an English and a Dutch one. The Dutch

version is found here as well.

The

English version is the one you are reading now.

It's time now to run that USA program, by downloading first the following bits

and pieces:

The Term Structure Data are definitely needed in order to be able to

run the English version of the program. They were downloaded from a USA

website called 'EconStats' (being no longer available, quite unfortunately).

The executable as well as the source code are free from CopyRights. Though

Anything Free comes without Guarantee, you may take a look inside the code,

in order to convince yourself that I am not cheating anybody.

The first RadioButton is for calibrating between the upper and lower levels

v_L and v_H of interest. I don't know yet what the physical Meaning

is of these levels ! That is to say: how they eventually are related to decay

of goods in the real world.

The second RadioButton is an attempt to relate the term structure to a single

article, with a single time of failure. It turns out that a lifetime of 20

years gives an approximation which, alas, is not a "bad" guess at all.

With articles

where interest and depreciation in aerospace industry are tabulated, you will

find further support for my finding that quality standards in our society do

not reach much longer in the future than an order of magnitude of say 10 years.

(Japan is a noteworthy exception)

The other RadioButtons provide several kinds of weighted summations over goods

with a lifetime somewhat shorter than the one selected (with the "SpinEdit").

You can walk through the Term Structure Data by either Edit-ing

the date (year-month-day) and press the Read Data button,

or simply by pushing the Next / Previous buttons.

Results

It is seen that the agreement between theory and experiment sometimes becomes

excellent indeed. And different choices, determining the precise shape of the

lifetimes distribution, do not make so much difference after all. It is also

observed that the term structure is mainly determined by the Short LifeTimes,

which represent the highest "risks" to the provider of the loan. It is clear

that nothing can be gained by betting on one good or another, for the purpose

of gaining more profit: since the decay times of all goods are so well known

to our Money. In fact, the reverse is true: supply and demand cause the Risk

to spread in such a way that nothing can be gained. That is: according to an

integral over short lifetimes of Depreciation curves of the goods, the Decay

of which actually generates the interest, the red (blood-colored)

Curves of Death will be formed. I am proud of my little Best

Fit Button, which performs a great deal of the task: fitting Death

Curves to the Federal Reserve's economic data.

Conclusions

So far so good. You are invited now to take a look at the positive side.

The point I am to make here is that ANY money reform, in order to succeed,

MUST be accompanied by a vast improvement of the lifetime, that is Quality

of our goods. Rent can be killed only if we deprive money of its principal

greed: to depreciate things in comparison to itself. If our goods are made

of Long Lasting Quality, alike the enduring persistence of gold, then

gold-money will no longer have any reason to act as it is a superior substance.

Sustainability is an Interest Killer. Which is all

clearly demonstrated these days by the interest-rates in Japan: dropping to

the level of zero, and even below zero ! Such happens because the quality

of Japanese goods tends to be excellent, when compared to US of America

products for example. But I have a tip / hint for Western Civilization.

Any Producer would like to produce a cheap car that depreciates fast, because

that would give him the "best" return. But the forces of competition are such

that he cannot do so, because the Consumer wants to have a car that does Not

depreciate fast. It's always a compromise between cheap profit of the producer

and the quality desired by the consumer. Steering in society should be simply

in such a way that the consumers always win. Let our commercials be made up by

Organizations of Consumers and you will soon see the difference !

Last but not least, the above demonstrates that it's not reasonable to

believe in Debt Free or Interest Free or Free Money, as has nevertheless been

proposed by several individuals and groups:

If society really wants to get rid of Debt and Interest bearing Money, then

IMO such a thing can only be accomplished by making the kind of money simply

redundant. The following two measures may seem somewhat far-fetched,

but they are logically motivated by the good old idea that having debt should

be discouraged, instead of encouraged. Thus, for the purpose to avoid

any borrowing from a bank:

- Things too expensive for most people (like houses) should not be sold, but

only be rent

- Companies should be large enough to be able to create their own financial

buffers for future investment

Published in the 'sci.econ' newsgroup with only one follow up, from

Rod Speed.